Manage taxes

Thelia 2 tax engine is based on taxes which can be combined into tax rules.

What is a tax ?

A tax is an effect based on a type

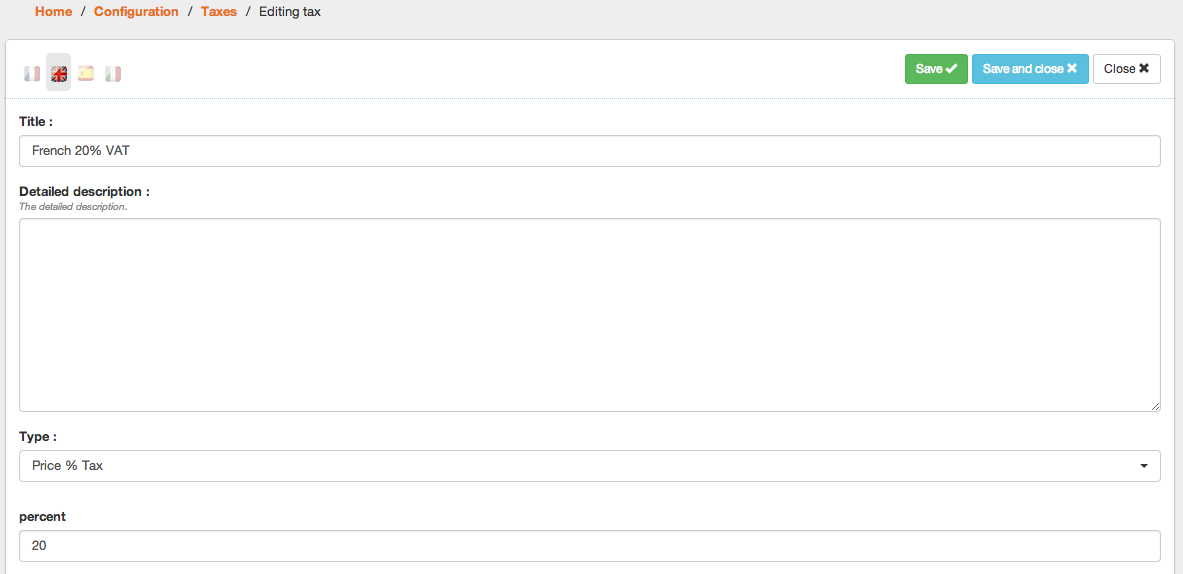

You can view, create, update and delete taxes in Configuration > Tax rules back-office menu.

For example, French 20% VAT is a Price % tax type whose amount is 20.

What is an tax rule ?

An tax rule is either a combination of taxes or a single tax. Tax rules are assigned to products ; each product has a single tax rule. Tax can differ depending on the country therefore a product can have different tax - or no tax - depending on the country.

You can view, create, update and delete tax rules in Configuration > Tax rules back-office menu.

When managing taxes in a tax rule, you can chose if a tax is applied on the already taxed price or not. Here is a complex example :

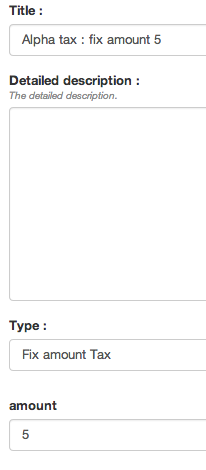

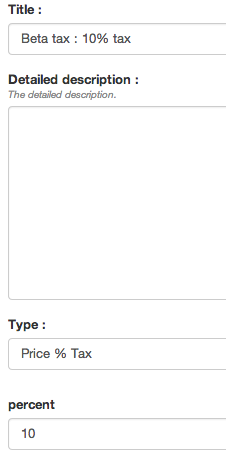

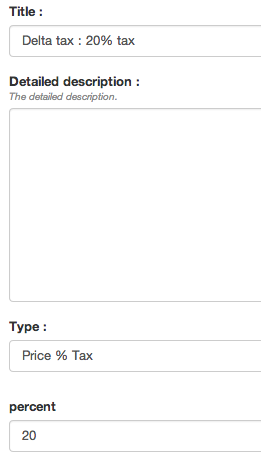

We created the 3 taxes below :

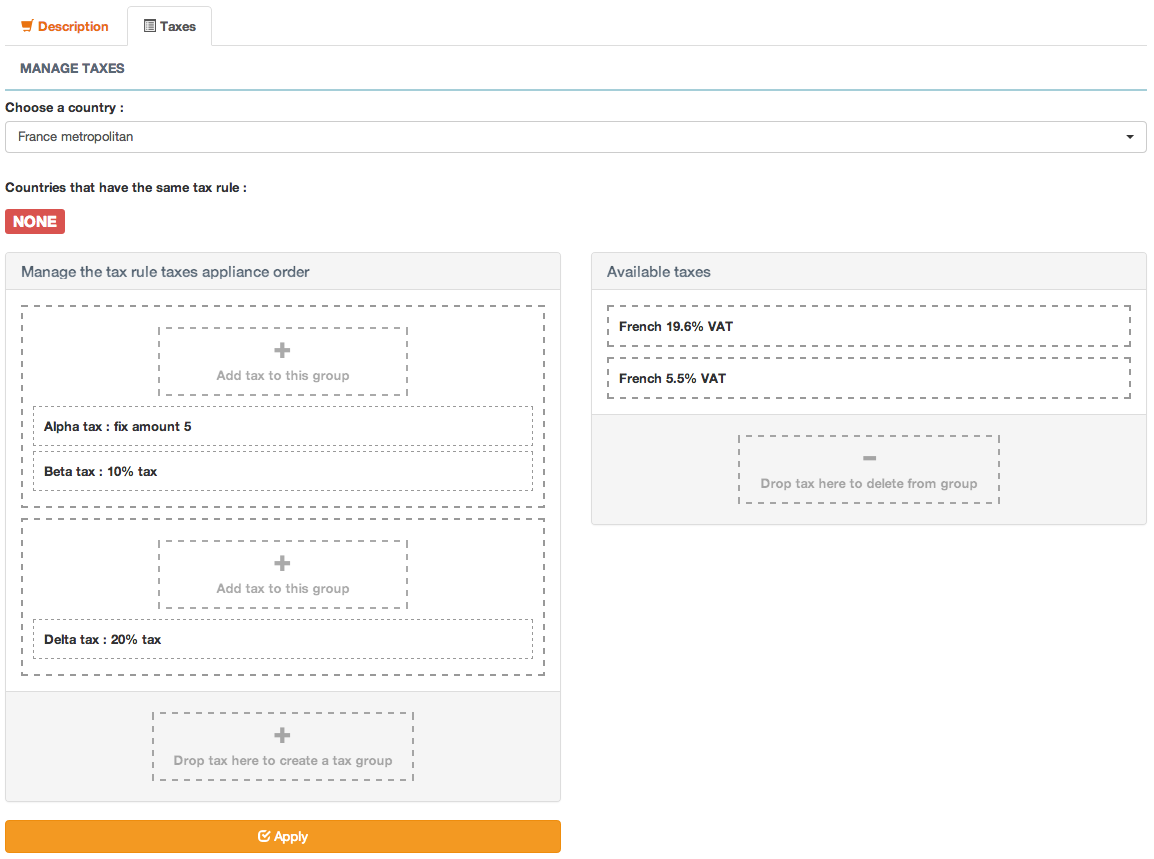

And we combined them into a new tax rule like this :

We put the alpha and beta tax in a first group and the delta tax in a second group.

Meaning we will calculate the tax amount for group 1 based on untaxed price, then we will calculate group 2 tax amount based on untaxed price plus group 1 tax.

Let’s do it for a 100 € product.

Untaxed price = 100

First we calculate group 1 taxes ; alpha tax = 5, beta tax = 100 * 10% = 10. So group 1 tax is 5 + 10 = 15 €

Then we calculate group 2 tax ; delta tax = (100+15) * 20% = 23 €

Total tax = 15 + 23 = 38 € ; Taxed price = 100 + 38 = 138 €